Bob’s Watches Rolex Data report for 10 years.

Recently, watch lovers and collectors may have seen the various articles appearing online that say that collecting Rolex watches over the past 10 years was better than collecting gold. Those articles stem largely from the report created by Bob’s Watches – online retailer of Rolex watches for more than a decade and experts on all things Rolex.

While their report does indicate that the value of Rolex watches over the past decade has skyrocketed, it doesn’t compare Rolex price increases to the precious metals price increases over the past 10 years. In fact, since early 2012, Gold prices have risen by almost 20 percent to $1,827.80 per ounce on February 9, 2022. Naturally, with many Rolex watches in the past decade being made of gold, their value has risen accordingly.

However, it is true that Rolex watches today are in hotter demand than ever and are commanding prices on the second-hand market that are astronomical compared to years ago. The key here is also the “secondary market” clause. Rolex is not gauging customers with the prices of its new timepieces sold at retail. Those prices have gone up commensurately with the market changes and inflation, but you can still find (if you can find one in stores) a Rolex watch for just around $6,000.

Bob’s Watches Rolex Data report for 10 years. Photo: Courtesy of Bob’s Watches.

The report from Bob’s says, “… over the course of the last decade, Rolex watches have outperformed every single one of them [real estate, precious metals and more] – and by a lot. It is estimated that Rolex produces around a million new watches each year, but this is nowhere near enough to meet the current global demand. This scarcity at a retail level has resulted in an incredibly active secondary market, where pre-owned Rolex watches trade hands for values that are significantly higher than what Rolex originally charged for them when they were brand-new.”

For this report, Bob’s Watches collected data from its pre- owned Rolex sales over the course of the last 10 years. The report says, “When it comes to a flat-out percentage increase, Rolex watches significantly outperformed both gold and real estate. This is based on inflation-adjusted values for the price of gold provided by macrotrends.net and median sales price data for houses sold in the United States from the Federal Reserve Economic Data (FRED) database.”

No percentages were given of the increases in sales for real estate or gold. Then the report refers to the past five years (several of which included the Pandemic years where people sat home and shopped online to indulge their passions when travel wasn’t an option): “Additionally, while the stock market (based on historical Dow Jones Industrial Average values from macrotrends.net) offered similar overall returns over the course of the last decade, Rolex watches offered a noticeably higher appreciation percentage when it comes to the last five years, and this trend only seems to be continuing into 2022.”

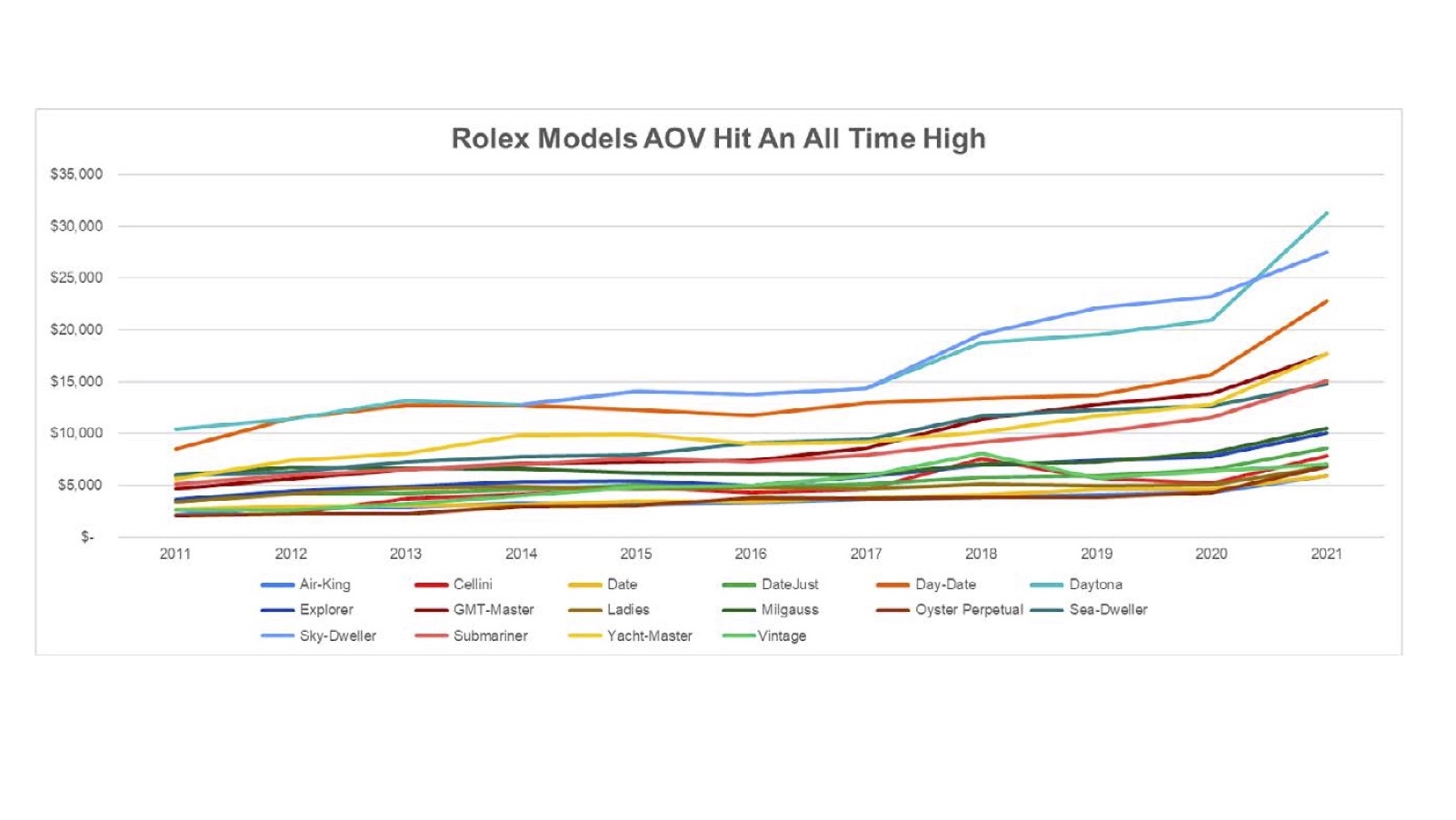

Bob’s Watches Rolex Data report for 10 years indicating appreciation of watches on the second-hand market by model.

Finally, halfway through the report, we get to the meat: “The average price of a used Rolex watch has gone from less than $5,000 in 2011 to more than $13,000 by the end of 2021. This increase is certainly noteworthy by all standards, but the amount that Rolex prices have gone up since the beginning of the pandemic (2020) is nearly equal to the total price increase that can be observed during the entire previous five-year period….”

Here is the real low down: the above-mentioned prices equate to about a 160 percent increase in the value of a single pre-owned watch. With gold, if someone purchased a single ounce (let’s face it, who buys one ounce of gold as an investment), he or she would have experienced much smaller growth in value. The report is accurate, but it makes the reader do the work (especially the math).

For collectors, the portion of the report that delineates price increases for various models of Rolex watches, could be worth some of that gold when it comes to purchasing decisions. “Looking at 10-year prices for all Rolex models, it becomes clear that virtually every single one of them has increased (to some degree or another) over the course of the last decade. While some models such as the Air-King and the Date have shown modest yet steady appreciation during this time, other collections such as the Daytona, Day-Date, and Sky-Dweller have more than doubled in price during this same 10-year period. What is also interesting to note is that since the Rolex Sky-Dweller was only introduced in 2012, it has achieved its impressive results in even less time than its siblings. With that in mind, the Daytona still claims the number one spot for the highest appreciating Rolex model, as it has more than tripled in value during the past 10 years, with an average pre-owned price of more than $30,000 for 2021.”

From there the report goes on to state which Rolex watches have appreciated in value and which are the most popular on the second-hand market. The most appreciated models since 2011: Sky-Dweller (which wasn’t introduced until 2021), Air-King, Day-Date, Submariner, GMT Master, Date and Milgauss — if one can interpret the multi-color chart accordingly.

The report is a good read, and a nice confirmation to Rolex collectors that, as of now, the brand’s second-hand watches are a great investment. However, I am not sure that was ever really a question.

Courtesy of Bob’s Watches